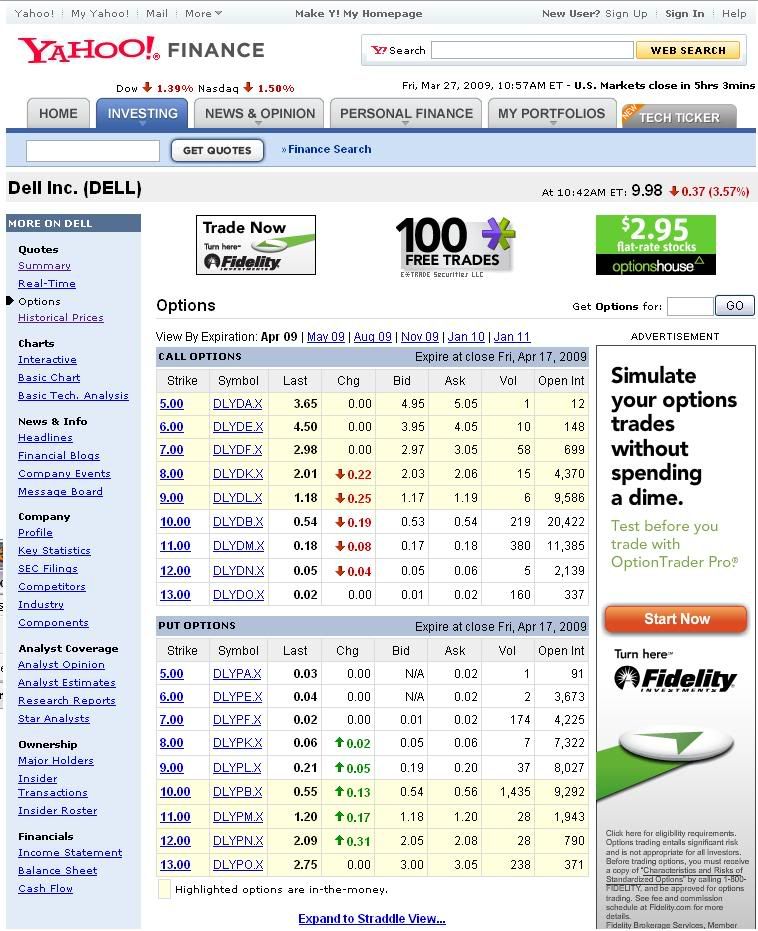

In this post we look as Options section under Quotes. Call option is in which the Buyer of the security has the right but not the obligation to buy the securities at a set price or exercise price at a certain time. Put option is exactly the opposite; the sellers side. And the Bid price is how much the buyer is willing to pay to buy the option. Just like previous Ask is the exact opposite.

Alright with that preliminary understanding lets look at the Options page of Yahoo finance. Yet again we look at Dell stock.

"View by expiration" is when the option expires.

Both the Call and Put option have similar information, so lets look at the Call option.

Strike - is the price at which the option is exercised. In the case of Call option, if you buy the option and the price of the security goes up, our strategy to make the best profit is exercise the Call option and buy the security at $5.00 (Strike price) and sell it on market for higher.

Symbol - has the symbols of all the different options with different values.

Bid - is the price the seller of the option would get.

Ask - is the price the buyer of the option would receive to purchase the option.

Vol - represent the number of those options available.

Open Int - "The total number of options and/or futures contracts that are not closed or delivered on a particular day. Or the number of buy market orders before the stock market opens." - investopedia.com

In this blog post we talked about Options section in yahoo finance -call and put options. And we went over what each column of the page means to an investor or a trader.

Learn to use Yahoo Finance: part 3

Friday, March 27, 2009 at Friday, March 27, 2009 Posted by ashPresentom (aP)

Labels: Yahoo Finance

Subscribe to:

Post Comments (Atom)

Search

Bookmark and Subscribe to ashPresentom

Categories of popularity at ashPresentom

Recent Topics

Blog Archive

-

▼

2009

(74)

-

▼

March

(21)

- Simple Genius by David Baldacci

- Networking computers, software update news

- Floral Graphic with overlay of pencil floral painting

- website compatibility across browsers

- Learn to use Yahoo Finance: part 3

- How to add RSS feed to a website using Javascript

- How to increase computer's speed after adding extr...

- Why is the header of a website important

- aP Novel Review: Hour game by David Baldacci

- Website developing: the Web div series introduction

- Sports highlights: India v New Zealand 1st Test, D...

- Venturing a new idea in tough economic times

- live India Vs. New Zealand 5th ODI (streamng)

- Learn to use Yahoo Finance, Part 2

- aP Novel Review: Split Second by David Baldacci

- Connecting two computers together: part 4, remote ...

- FinAnalysis, part 4: Operating Margin

- aP Review Divine Justice by Dald Baldacci

- Connecting two computers together over network: pa...

- Unemployment rates for February; How bad is it?

- Stock market tumbling analysis for the first week ...

-

▼

March

(21)

Live Traffic

Blogger Template Designed by B-Themes | 2008 ©ashPresentom All Rights Reserved.

Content Published in this blog are copy righted material of ashPresentom

0 comments:

Post a Comment